7 Benefits of Hiring a Virtual CFO for Streamlining Your Business Finances

Are you struggling to keep your business finances organized and on track? You’re certainly not the only one facing this challenge. Many entrepreneurs find themselves overwhelmed by the complexities of financial management, often wishing they had a trusted advisor to guide them. A virtual CFO can provide strategic insights and support can help you with […] The post 7 Benefits of Hiring a Virtual CFO for Streamlining Your Business Finances appeared first on Entrepreneurship Life.

Are you struggling to keep your business finances organized and on track? You’re certainly not the only one facing this challenge. Many entrepreneurs find themselves overwhelmed by the complexities of financial management, often wishing they had a trusted advisor to guide them. A virtual CFO can provide strategic insights and support can help you with this.

In this blog, we’ll explore seven key benefits of hiring a virtual CFO, showing you how this innovative solution can streamline your financial processes and help your business thrive. Ready to unlock the potential of your finances? Let’s dive in!

Who is a Virtual CFO?

A virtual chief financial officer, or VCFO, is an expert providing high-level financial strategy and management services remotely. This modern innovation offers the business the expertise of a seasoned CFO without having to bear the overhead cost of a full-time executive. Typically part-timer, generally on a project or retainer basis, a VCFO closely resembles a traditional CFO but affords the business great flexibility.

Therefore, hiring a virtual CFO would be an excellent opportunity for any business to optimize its financial operations. These virtual cfo services bring experience and specialized knowledge to the table that allows companies to navigate complex financial landscapes with agility and precision.

Why Does a Business Need a Virtual CFO?

A business needs a virtual CFO to get expert financial help at a lower cost than hiring a full-time CFO. The virtual cfo service provides flexibility to adapt to business needs and bring along valuable insights into other industries for a better financial strategy.

Outsourcing financial management gives business owners time to focus on core businesses while being helped by smart financial planning, risk management, and cash flow handling. This ensures that the regulations are met, keeping the business out of financial problems, and achieving healthier and better financial status and growth.

1. Enhanced Financial Strategy Development

A successful financial strategy is the backbone of your organization, and a VCFO service can provide you with a financial plan that is customized according to your business goals and prevailing market conditions. Virtual CFOs align themselves with your leadership team to ensure financial strategies are in step with business objectives and promote sustainable growth.

Your business will be more prepared to adapt to changes in the market through vast industrial exposure by your virtual CFO. They also use advanced modeling techniques for scenario planning, helping organizations anticipate financial challenges and prepare alternative actions to ensure operations continue despite economic changes.

2. Cost-Effective Financial Management

Every dollar saved is a dollar earned, making cost-effective financial management important today. Virtual CFOs offer:

- Cost-effective services compared to a traditional CFO as they eliminate cost benefits and office space.

- Offer flexible plans which allow you to pay only for what you need.

- Access to high-level experience and industry insights without a full-time salary.

This efficient management enhances better decisions and improves your performance in the financial sense.

3. Improved Cash Flow Management

Cash flow is a very important aspect of business stability, and virtual CFO services enhance management with real-time monitoring and optimization of cash flow processes. Virtual CFOs track cash flow using advanced tools, which makes it possible to detect potential problems or weaknesses and undertake corrective actions on time.

They also streamline invoicing to speed up cash inflows and develop strategies that reduce late payments and bad debts, improving the cash flow.

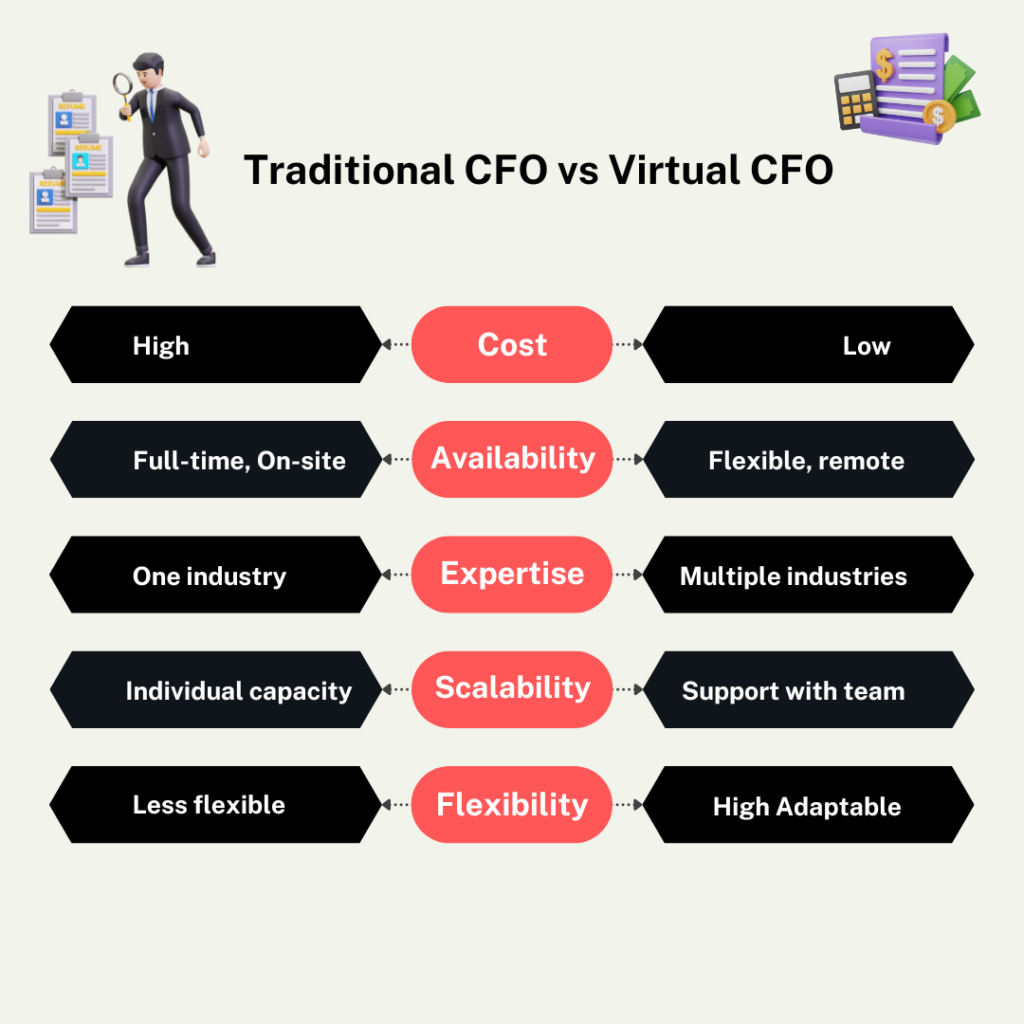

To answer your question better, here’s a comparison between traditional and virtual CFO services:

From the above comparison, we can say that virtual CFO services are more flexible and cost-effective. Thus, virtual CFO services come to serve businesses looking to optimize their financial management.

4. Financial Reporting

Relevant data can be used to prepare clear financial reports, and virtual CFOs are the best at making these insightful documents. They identify and track key performance indicators tailored to your business, making it easier to assess financial health. Advanced data visualization techniques simplify complex information, allowing the management to expedite decision-making.

Virtual CFOs also check financial setups periodically, make necessary adjustments to strategies, and observe whether or not your business stays in line with financial regulations which remove risks and attach certain penalties to it.

5. Strategic Guidance and Business Growth

Strategic guidance from Virtual CFOs:

- Offer strategic advice on business expansion opportunities.

- Analyze market conditions and apply industry knowledge to determine promising investments.

- Provide expert recommendations on resource allocation to ensure the highest growth potential.

Virtual CFOs help businesses in mergers and acquisitions by conducting suitable targets through financial assessment and recommending deal structuring to minimize value destruction and take risks effectively.

6. Streamlined Financial Processes

Streamlining financial processes with the help of virtual CFOs can lead to significant time and cost savings. They adopt modern, and tailored financial software that increases operational efficiency and frees up resources through automation of repetitive activities, which reduces the chances of errors. Virtual CFOs allow finance and other departments to communicate on behalf of teams to align financial objectives with broader organization goals, which improves overall business efficiency.

7. Expert Compliance and Risk Mitigation

Virtual CFOs have outstanding compliance and risk mitigation in regulatory environments. They ensure your business has accurate tax filings, stay updated on changes in tax laws, protect your business from most penalties, and help you identify tax-saving opportunities to maximize the potential of your deductions. Virtual CFOs also establish and maintain a strong set of internal controls that protect the integrity of your organization at regular intervals. They also provide safety to your business by building resilience to any financial risks and vulnerabilities.

Conclusion

Some of the benefits that accrue from the adoption of a virtual CFO include better financial strategies and compliance expertise. With virtual CFO services, businesses can draw world-class financial expertise without the cost burden of a full-time executive. Virtual CFO services offer flexible cost-effectiveness and unparalleled strategic insight into contemporary financial management.

Consider the potential growth and efficiency a virtual CFO can bring to your business. In an era where agility and expertise are key to success, partnering with a virtual CFO could be the strategic move that propels your business to new heights of financial performance and stability.

Frequently Asked Questions (FAQs)

- What services does a virtual CFO provide?

A virtual CFO offers a range of services, including financial strategy development, cash flow management, financial reporting, tax planning and compliance, and risk management. The virtual CFO service is designed to meet the specific requirements of your business.

- How does hiring a virtual CFO benefit my business?

A virtual CFO represents one of the most accessible ways to have top-level financial capabilities accessible to assist with strengthening financial choices, improving cash flow, spotting growth opportunities, and providing rule-of-law compliance for a successful business.

- What industries can benefit from virtual CFO services?

Virtual CFO services benefit the industries of startups, small and medium-sized enterprises, e-commerce, and even non-profit organizations. Any business that needs finance guidance and support can easily leverage the knowledge or insight of a virtual CFO.

The post 7 Benefits of Hiring a Virtual CFO for Streamlining Your Business Finances appeared first on Entrepreneurship Life.